Envelope Budget Planning for Large Commercial Projects sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality.

In the following paragraphs, we will delve into the key aspects of envelope budget planning for large commercial projects, providing valuable insights and practical tips for effective project financial management.

Overview of Envelope Budget Planning for Large Commercial Projects

Envelop budget planning is a financial management strategy commonly used in large commercial projects to control expenses effectively. This method involves setting aside specific amounts of money for different project categories or phases, similar to placing cash in separate envelopes for groceries, bills, and entertainment.

Benefits of Envelope Budget Planning

- Helps in allocating funds efficiently: By dividing the project budget into distinct categories, envelope budget planning ensures that money is allocated based on priority and necessity.

- Prevents overspending: Since each envelope represents a specific aspect of the project, it helps to avoid exceeding the budget for any particular area.

- Enhances financial visibility: Envelope budget planning provides a clear overview of where the money is being spent, making it easier to track expenses and make informed decisions.

- Encourages accountability: Team members are accountable for managing the budget allocated to their respective envelopes, fostering responsibility and transparency in financial matters.

Successful Implementations of Envelope Budget Planning

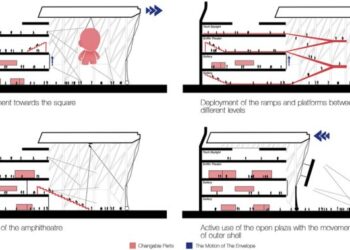

- In the construction industry, large commercial projects often use envelope budget planning to manage costs related to materials, labor, permits, and other expenses.

- Real estate developers utilize envelope budgeting to track and control expenditures for land acquisition, construction, marketing, and sales in their projects.

- Infrastructure projects like road construction, bridges, and public facilities benefit from envelope budget planning to ensure that funds are allocated efficiently across different phases of the project.

Setting Up Envelope Budgets for Large Commercial Projects

Setting up envelope budgets for large commercial projects involves a detailed process to ensure that funds are allocated efficiently and effectively. By breaking down the project into different aspects and assigning specific budgets to each, project managers can better manage costs and track expenses throughout the project lifecycle.

Creating Envelope Budgets

To create envelope budgets for large commercial projects, follow these steps:

- Identify key project components: Break down the project into different aspects such as construction, materials, labor, permits, equipment, and contingency.

- Estimate costs: Conduct a thorough cost analysis for each aspect based on project requirements, market rates, and historical data.

- Allocate funds: Determine the budget allocation for each envelope based on the estimated costs and project priorities.

- Monitor and adjust: Regularly review the envelope budgets, track expenses, and make adjustments as needed to ensure that funds are utilized effectively.

Guidelines for Allocating Funds

When allocating funds to envelope budgets, consider the following guidelines:

- Priority areas: Allocate a larger portion of the budget to critical areas such as construction and labor to ensure project completion within budget and timeline.

- Contingency: Set aside a contingency fund to account for unexpected costs or changes in project scope.

- Flexibility: Maintain flexibility in budget allocation to accommodate any fluctuations in costs or unforeseen circumstances.

- Regular review: Review and adjust envelope budgets periodically to align with project progress and changes in requirements.

Tools for Managing Envelope Budgets

Several tools and software can aid in setting up and managing envelope budgets efficiently, such as:

- Budgeting software: Use specialized budgeting software that allows for easy tracking, monitoring, and analysis of envelope budgets.

- Project management tools: Integrate envelope budgets with project management tools to streamline communication, collaboration, and budget tracking.

- Spreadsheet applications: Utilize spreadsheet applications like Microsoft Excel or Google Sheets to create and maintain envelope budgets with customizable features.

Monitoring and Tracking Expenses in Envelope Budgets

Monitoring and tracking expenses in envelope budgets is crucial for the successful management of large commercial projects. By keeping a close eye on expenditures and comparing them against the allocated budgets, project managers can ensure that the project stays on track financially.

Strategies for Tracking Expenses in Real-Time

- Utilize expense tracking software: Implementing software that allows real-time tracking of expenses can provide instant visibility into where the money is being spent.

- Regularly update budget reports: By updating budget reports frequently, project managers can monitor expenses as they occur and make informed decisions to prevent overspending.

- Implement spending controls: Set up approval processes for expenses above a certain threshold to avoid unexpected costs and maintain control over the budget.

Importance of Regular Reviews and Adjustments

Regular reviews of envelope budgets are essential to identify any discrepancies or areas of overspending. By analyzing expenditure patterns, project managers can make necessary adjustments to the budgets to reallocate resources effectively. This continuous monitoring and adjustment process helps in ensuring that the project remains within budget constraints and avoids financial setbacks.

Adapting Envelope Budgets to Changing Project Needs

Adapting envelope budgets to changing project needs is crucial for successful project management. As projects progress, unexpected changes in scope, requirements, or external factors may arise, necessitating adjustments to the budgeting approach. Flexibility is key to ensuring that the project stays on track while accommodating these changes effectively.

Modifying Envelope Budgets for Large Commercial Projects

In the context of large commercial projects, there are several scenarios where envelope budgets may need to be modified:

- Scope Changes: If there are additions or reductions in project scope, the budget must be adjusted accordingly to reflect the new requirements.

- Resource Reallocation: Shifts in resource allocation may require changes in budget allocations to optimize spending and ensure project success.

- External Factors: Economic changes, market trends, or regulatory updates may impact the project budget, necessitating adjustments to maintain financial health.

Best Practices for Maintaining Flexibility in Budget Adaptations

To maintain flexibility while adhering to overall budget constraints, consider the following best practices:

- Regular Review: Continuously monitor project progress and budget performance to identify early signs of budget adjustments.

- Communication: Foster open communication channels within the project team to discuss potential budget modifications and seek input from key stakeholders.

- Contingency Planning: Allocate a contingency fund within the envelope budget to address unforeseen expenses or changes without derailing the project.

- Data-Driven Decisions: Base budget adaptations on data analysis, historical trends, and accurate forecasting to make informed decisions that align with project goals.

- Documentation: Keep detailed records of budget modifications, reasons for changes, and impact assessments to ensure transparency and accountability throughout the project lifecycle.

Last Word

To wrap up our discussion, Envelope Budget Planning for Large Commercial Projects proves to be a strategic tool in ensuring project success by effectively managing finances and adapting to changing needs. Take the first step towards financial control and project efficiency with envelope budget planning.

Questions and Answers

How does envelope budgeting differ from traditional budgeting methods?

Envelope budgeting involves allocating funds to specific categories and physically separating them, providing a visual representation of where money is allocated, unlike traditional budgeting methods.

What are the benefits of using envelope budget planning for large commercial projects?

Envelope budget planning helps in better tracking and control of project finances, ensures funds are allocated to specific project aspects, and allows for easy adjustments to changing project needs.

How can envelope budgets be adjusted to accommodate changes in project scope?

Envelope budgets can be modified by reallocating funds from one envelope to another, revising budget allocations based on new project requirements, and ensuring regular reviews to adapt to changing needs.